What Are the Best Monthly Saving Methods?

Managing personal finances effectively is a priority for individuals worldwide. Saving money monthly can provide financial security, reduce stress, and help achieve long-term goals. This article outlines the best monthly saving methods, focusing on practical, ethical, and universally applicable strategies that cater to diverse audiences.

Table of contents

- What Are the Best Monthly Saving Methods?

- 1. Why Save Money Monthly?

- 2. How to Create a Monthly Saving Plan?

- 3. What Are Effective Saving Methods?

- 4. How to Save Without Sacrificing Too Much?

- 5. How Can Technology Help in Saving?

- 6. What Are Culturally Ethical Saving Practices?

- 7. How to Stay Motivated?

- 8. Are There Studies Supporting These Methods?

- Conclusion

- FAQ: Monthly Saving Methods

1. Why Save Money Monthly?

Saving money monthly has numerous benefits, including:

- Building an Emergency Fund: Unforeseen events, like medical emergencies or job loss, can occur unexpectedly. A solid savings plan acts as a safety net.

- Achieving Financial Goals: Savings help finance significant milestones, such as education, homeownership, or business investments.

- Reducing Financial Stress: Consistent saving builds confidence in handling expenses and reduces reliance on debt.

Example: A 2023 study by NerdWallet found that individuals with emergency funds reported 50% less financial stress than those without.

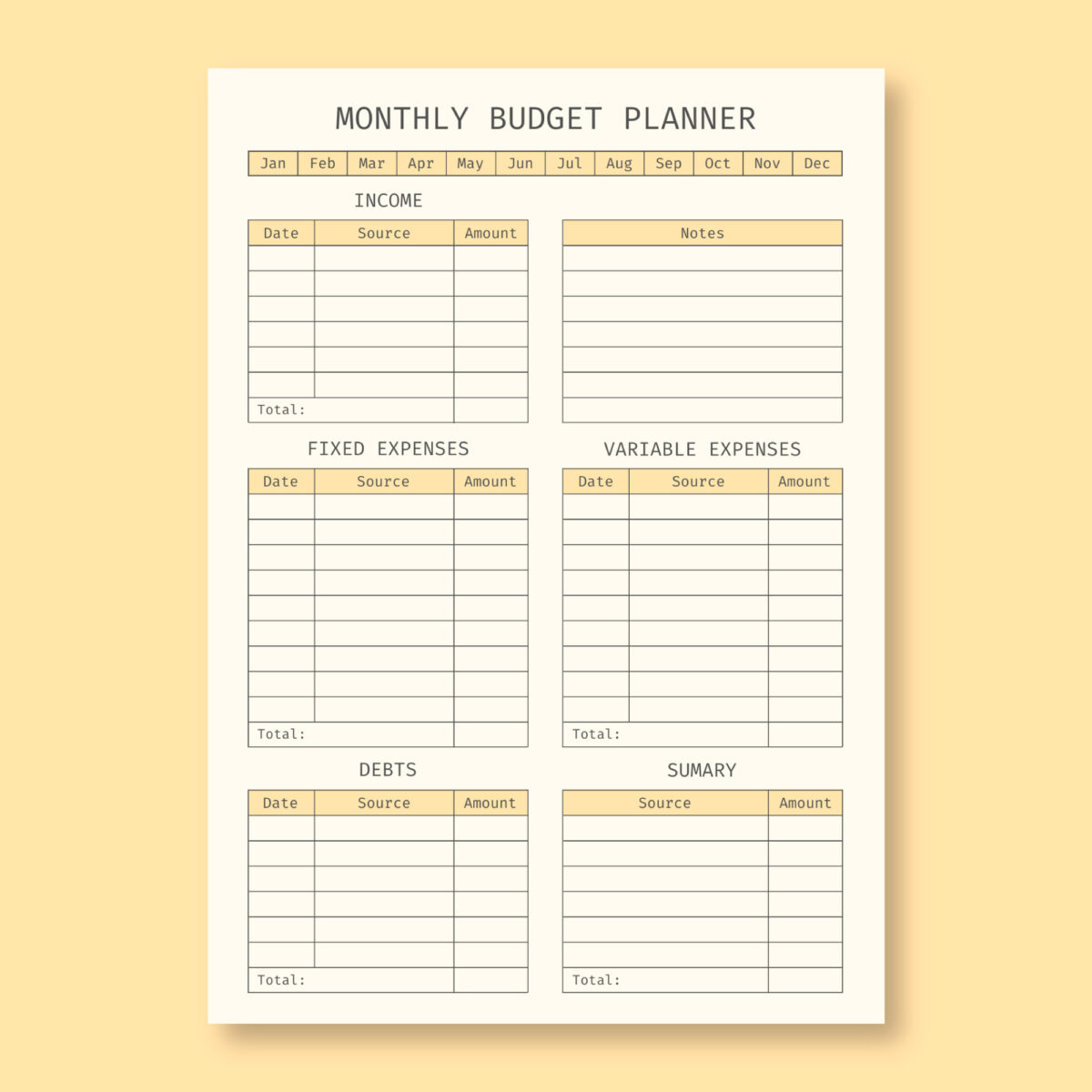

2. How to Create a Monthly Saving Plan?

Step 1: Set Clear Goals

Define short-term and long-term financial objectives. Examples include:

- Saving $500 monthly for a vacation.

- Building a $10,000 emergency fund within two years.

Step 2: Track Your Expenses

Monitor your spending habits to identify areas for improvement. Tools like Mint and YNAB (You Need A Budget) simplify expense tracking.

Step 3: Create a Budget

Allocate your income using the 50/30/20 Rule:

- 50% for necessities (rent, utilities, groceries).

- 30% for discretionary spending (entertainment, hobbies).

- 20% for savings and debt repayment.

Step 4: Automate Savings

Set up automatic transfers to a dedicated savings account. This removes the temptation to spend.

3. What Are Effective Saving Methods?

3.1. Pay Yourself First

Prioritize savings by allocating a portion of your income before spending on other expenses. For instance, commit to saving 20% of your monthly income.

3.2. Reduce Unnecessary Expenses

Evaluate subscriptions, dining habits, and impulse purchases. Opt for cost-effective alternatives, such as:

- Preparing meals at home instead of eating out.

- Using public transport instead of driving.

Case Study: A family of four reduced dining expenses by $200 monthly by meal planning and cooking at home.

3.3. Use the Envelope System

Allocate cash for specific categories (e.g., groceries, entertainment) in labeled envelopes. Once an envelope is empty, avoid additional spending in that category.

3.4. Increase Income Streams

Explore additional sources of income, such as freelancing, teaching, or selling handmade goods. Platforms like Upwork and Etsy make these endeavors easy.

4. How to Save Without Sacrificing Too Much?

4.1. Embrace Minimalism

Focus on essentials and avoid clutter. This mindset reduces impulse buying and fosters intentional living.

4.2. Take Advantage of Discounts and Coupons

Use cashback apps and discount codes to save on purchases. Websites like Rakuten and Honey simplify this process.

4.3. Switch to Energy-Efficient Solutions

Reduce utility bills by:

- Use of LED lights.

- Turning off appliances when not in use.

Statistic: The U.S. Department of Energy states that LED bulbs consume 75% less energy than incandescent lighting.

5. How Can Technology Help in Saving?

5.1. Budgeting Apps

Tools like PocketGuard and Personal Capital offer real-time expense tracking and budgeting insights.

5.2. Round-Up Saving Apps

Apps like Acorns and Qapital round up purchases to the nearest dollar and save the difference automatically.

5.3. Investment Platforms

Low-risk investment platforms, such as Wealthfront or Betterment, allow users to grow their savings passively.

6. What Are Culturally Ethical Saving Practices?

6.1. Community Savings Plans

Participate in collective saving initiatives like rotating savings and credit associations (ROSCAs). These foster trust and shared financial responsibility.

6.2. Charity as a Financial Discipline

Allocate a portion of your savings for charitable acts, encouraging mindfulness and gratitude.

7. How to Stay Motivated?

7.1. Visualize Your Goals

Create a vision board representing your financial objectives to reinforce motivation.

7.2. Celebrate Small Milestones

Reward yourself modestly upon reaching short-term goals to maintain enthusiasm.

7.3. Join a Community

Engage with online forums or groups focused on personal finance. Sharing experiences fosters accountability and learning.

8. Are There Studies Supporting These Methods?

- Expense Tracking Effectiveness: A 2020 report from The Balance highlighted that 65% of individuals who track expenses save more consistently.

- Automation Benefits: A study by Investopedia revealed that automated savings accounts increased saving rates by 40%.

- Minimalism Impact: Research by Psychology Today found that adopting minimalism improves financial habits and mental well-being.

Conclusion

Saving money monthly is essential for financial stability and achieving long-term goals. By adopting a structured plan, utilizing technology, and implementing ethical saving practices, individuals worldwide can secure their financial future without compromising their values. Start small, remain consistent, and watch your savings grow.

FAQ: Monthly Saving Methods

- Why is saving money monthly important?

Saving money monthly helps build an emergency fund, achieve financial goals, and reduce financial stress. It provides a safety net for unforeseen events like medical emergencies or job loss. - How can I create a monthly saving plan?

Start by setting clear financial goals, tracking expenses, creating a budget (e.g., the 50/30/20 rule), and automating savings into a dedicated account. - What are some effective saving methods?

- Pay yourself first by prioritizing savings before other expenses.

- Reduce unnecessary spending, like dining out or unused subscriptions.

- Use tools like the envelope system for better spending control.

- Increase income through freelancing or side hustles.

- How can I save without sacrificing too much?

Embrace minimalism, take advantage of discounts and cashback apps, and adopt energy-efficient solutions like LED bulbs to lower utility bills. - How can technology help with saving?

Use budgeting apps (e.g. YNAB), round-up saving apps (e.g., Acorns), and low-risk investment platforms (e.g., Betterment) to simplify and grow your savings. - What are culturally ethical saving practices?

Participate in community savings plans (e.g., ROSCAs) or allocate a portion of savings for charitable acts, promoting gratitude and shared financial responsibility. - How can I stay motivated to save?

Visualize financial goals, celebrate small milestones, and engage with online communities to maintain accountability and inspiration. - Are these saving methods supported by studies?

Yes! Research shows that expense tracking, automation, and minimalism significantly improve saving habits and overall financial well-being.

Sources

Image Resources:

- Designed by Wepik / Freepik

- pixabay.com

- unsplash.com

- pexels.com